To be the most pioneering, innovative, and robust bank.

Create the opportunities of success for our community by being the most responsive bank.

The National Bank “TNB” is the second largest bank in Palestine and the fastest growing in the country. Since its inception, it has proven that it is one of the best and most innovative providers of integrated and comprehensive national banking services for the corporate and retail sectors. It also provides investment, treasury and financing services for small, medium and micro enterprises.

Under the slogan «Confidently Forward», the National Bank provides the finest modern and advanced banking services in Palestine, and seeks to become the bank of choice for Palestinians looking for a strong, secure and sound financial services provider. Its goal is to provide advanced banking services that keep pace with the latest global banking technology developments. TNB has been developing a package of digital services and solutions that are offered for the first time in Palestine or even in the Middle East.

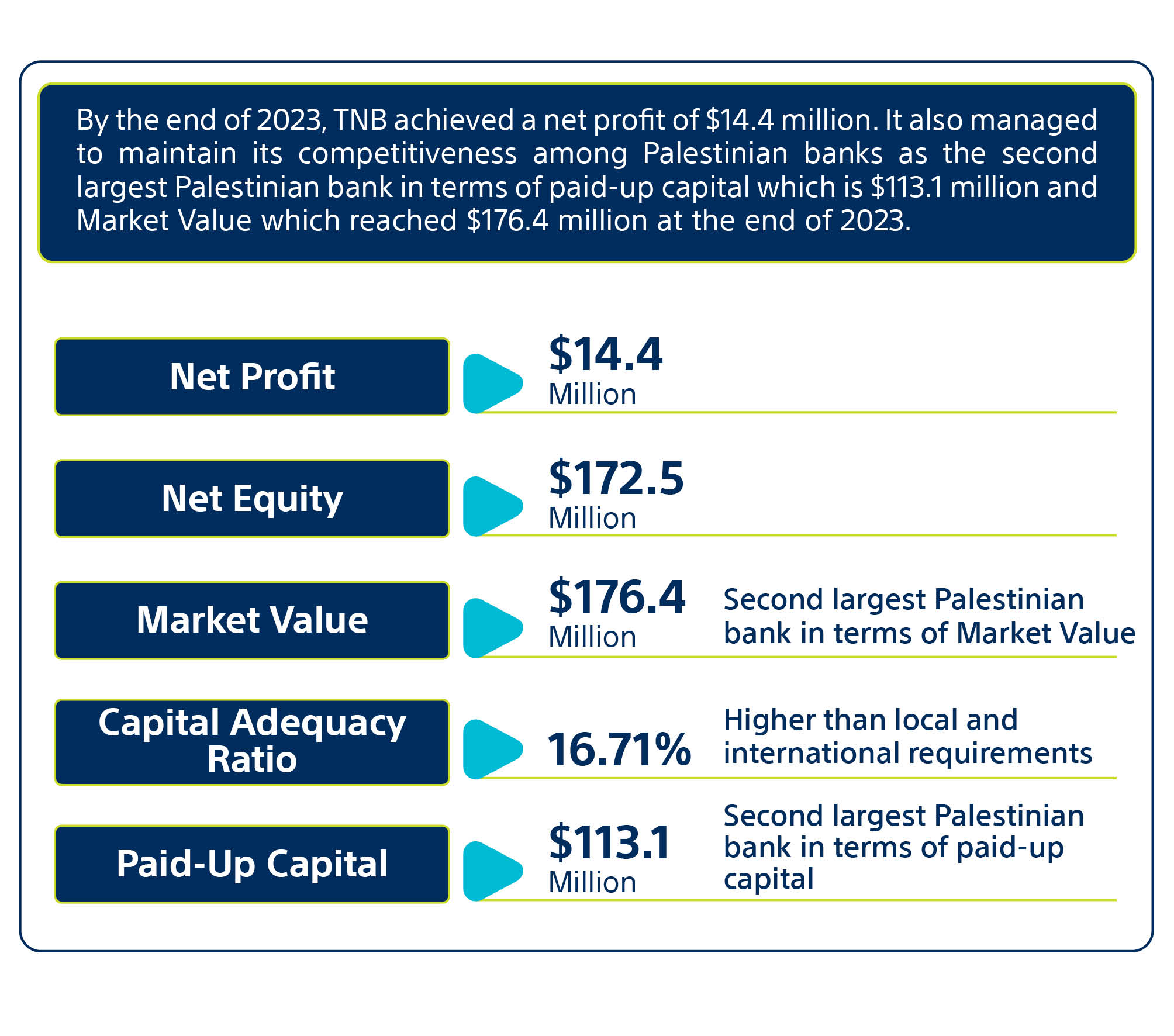

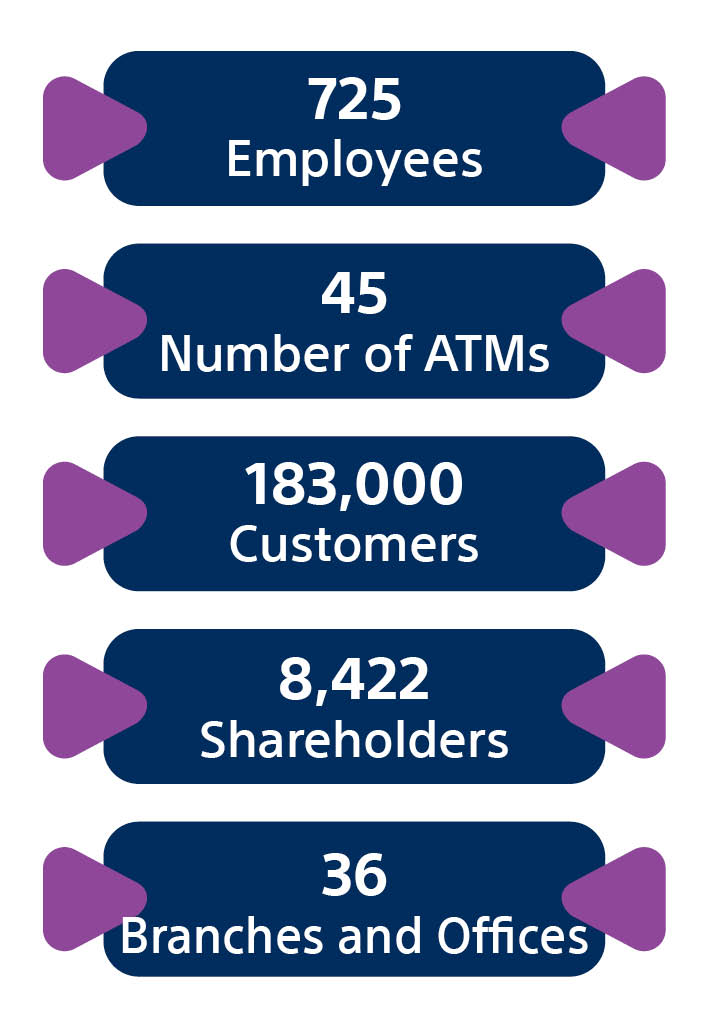

The bank’s Paid-up capital is approximately 113.1 million US dollars, and its authorized capital was raised to 115 million US dollars in 2022. TNB is managed by a Board of Directors that includes a group of the largest Palestinian companies, and some of the most prominent and talented businesspeople. It has the largest number of shareholders among banks in the country, exceeding 8,400.

The National Bank provides banking services to more than 183,000 clients, through its network of branches located in various governorates of the West Bank, and its well-located ATMs. It also provides its services through its modern digital channels such as Online Banking and the TNB Mobile application for smart phones, in addition to the Digital Service Center, which is the first of its kind in the Middle East. In 2017, after a fifty-year absence of Palestinian banks in Jerusalem, TNB was the first Palestinian bank to inaugurate a branch behind the wall to serve the residents of the city. Environment protection and clean and renewable energy are some of the most important values for TNB. TNB was a leader amongst banks to invest in solar energy; the bank purchased a stake in the “Noor Jericho” solar plant that now provides approximately most of its energy needs.

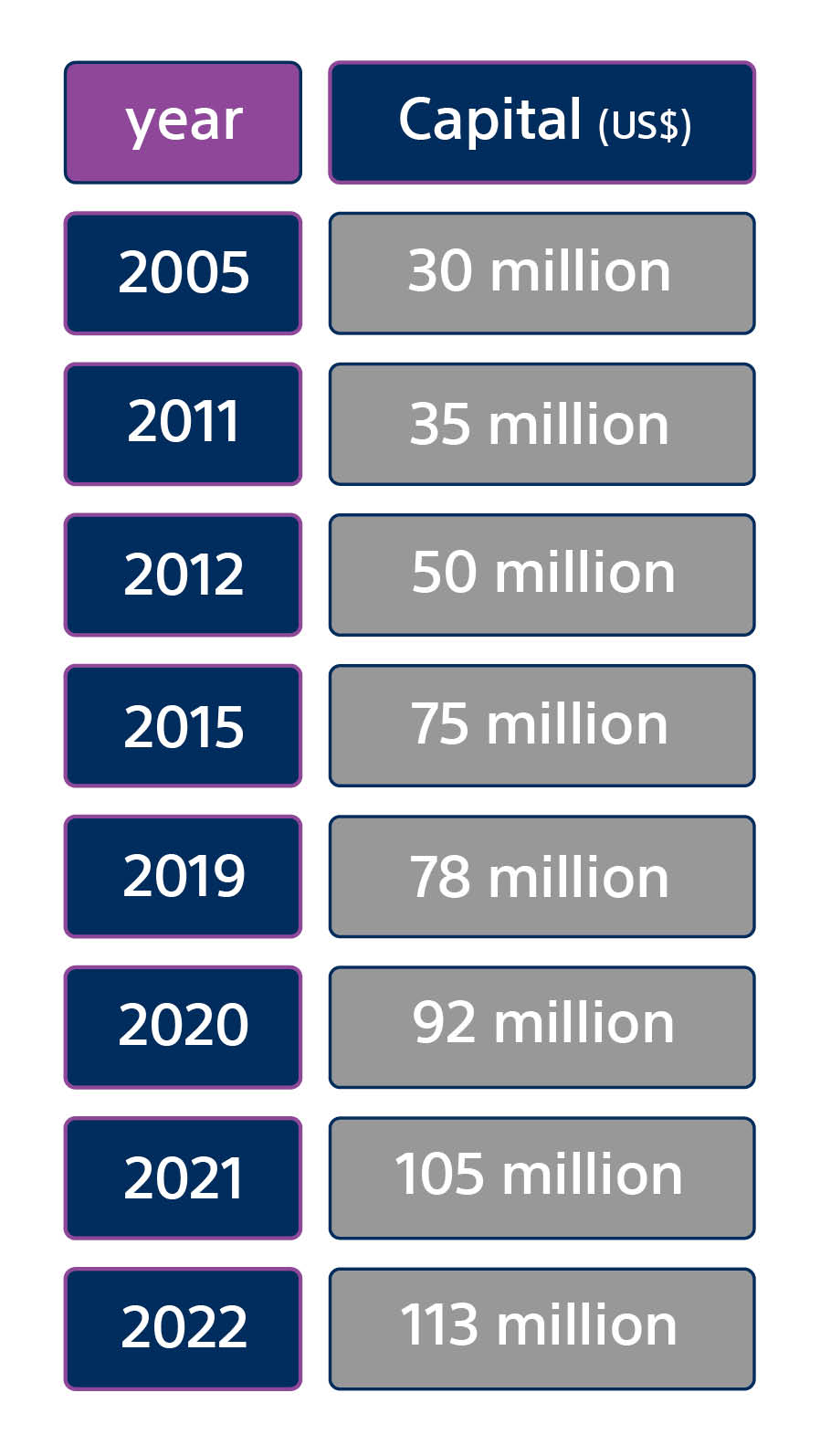

TNB was established on August 20, 2005 as a public shareholding company by Palestinian businesspeople and companies, with the aim of developing the Palestinian economy in general and providing excellent banking services. It was established with a capital of US$ 30 million dollars: %38 was subscribed by the founders of the bank and the rest by public subscription. The remaining shares were distributed among more than 18,000 shareholders.

By the end of 2012, the National Bank was re- launched with a new identity, in implementation of the merger agreement between Al Rafah Microfinance Bank and the Arab Palestinian Investment Bank (APIB) with a paid-up capital of US$ 50 million. TNB became a new strong national banking entity capable of covering all the banking needs of the Palestinian society.

In early 2015, TNB acquired the assets and liabilities of Bank al Etihad in Palestine. Following that deal, Bank al Etihad became a strategic partner in TNB with %10 share of its paid-up capital. After this transaction, TNB became the second largest Palestinian bank in terms of pai-up capital.

In 2019, the General Assembly approved raising the authorized capital to US$ 100 million, and the bank’s paid-up capital was increased to 78$ million by distributing 4% bonus shares. In early 2020, TNB acquired the assets and liabilities of the Jordan Commercial Bank (JCB) in Palestine and became a strategic partner in TNB, after offering a private offering of 13.76 million shares, and owning 15% of the paid-up capital which was raised to US$ 92 million.

In 2021, the bank’s paid-up capital was raised to approximately US$ 105 million after offering 13.76 million shares in a secondary public offering to the bank’s shareholders leading to the coverage ratio from additional shares reaching %93. TNB thus remained the second largest Palestinian bank in terms of paid-up capital.

In 2022, to implement the General Assembly’s decision to distribute dividends in the form of bonus shares, 8.5 million shares were listed on the Palestine Exchange, raising TNB’s paid-up capital from US$ 105 million to US$ 113.1 million.

In continuation of its pioneering and distinguished role in various fields, the National Bank was able to gain local and regional attention and win numerous awards in various fields, including:

WatanInvest

WatanInvest

The National Bank owns 100% of "WatanInvest Private Shareholding Company", which was acquired following an agreement between Al Rafah Microfinance Bank and the Arab Palestinian Investment Bank. Accordingly, the Arab Palestinian Investment Bank became wholly owned by TNB and its name was changed.

National Islamic Investment Company (NIIC)

National Islamic Investment Company (NIIC)

The National Bank owns %100 of the National Islamic Investment Company, which was established in 2018. Through NIIC, TNB acquired a direct stake in the Palestine Islamic Bank (PIB) amounting to %25 of its shares.

Dear shareholders,

I submit to you the 2023 annual report of The National Bank (TNB). 2023 was a sad year for Palestine and our people following the war on Gaza which targeted all aspects of life, and its humanitarian, social, and economic repercussions.

Similarly to all Palestinian banks and companies, we were affected by the war on Gaza and its repercussions. Although we do not have any branches in the Gaza Strip, our investments in the Palestine Investment Bank (PIB) which operates there were affected, as PIB was directly impacted by the war. The repercussions of the war also had an automatic effect on the economic situation in the second part of the country. In light of the clearance crisis and the layoff of Palestinian workers inside the green line, liquidity decreased, which prompted us to respond quickly. We enhanced liquidity and hedging by increasing allocations, which led to a decline in our profits for 2023.

Despite these challenging circumstances, we continued to work and were able to achieve a satisfactory financial performance. We completed all construction and development projects to become stronger from within, leading to sustainable achievements that support our growth and progress.

2023 Development plans

In 2023, we continued to implement our development plans to achieve the ambitious goals of our strategic plan. The goals include a number of basic IT and central operations infrastructure projects. Our efforts were focused this year on preparing for the launch of the new core banking system and supporting systems. This will provide a solid foundation for the launch of additional digital banking products that keep pace with the latest developments and can support our business growth. It will also provide an enhanced technological environment for control and oversight systems and for the principles of good corporate governance.

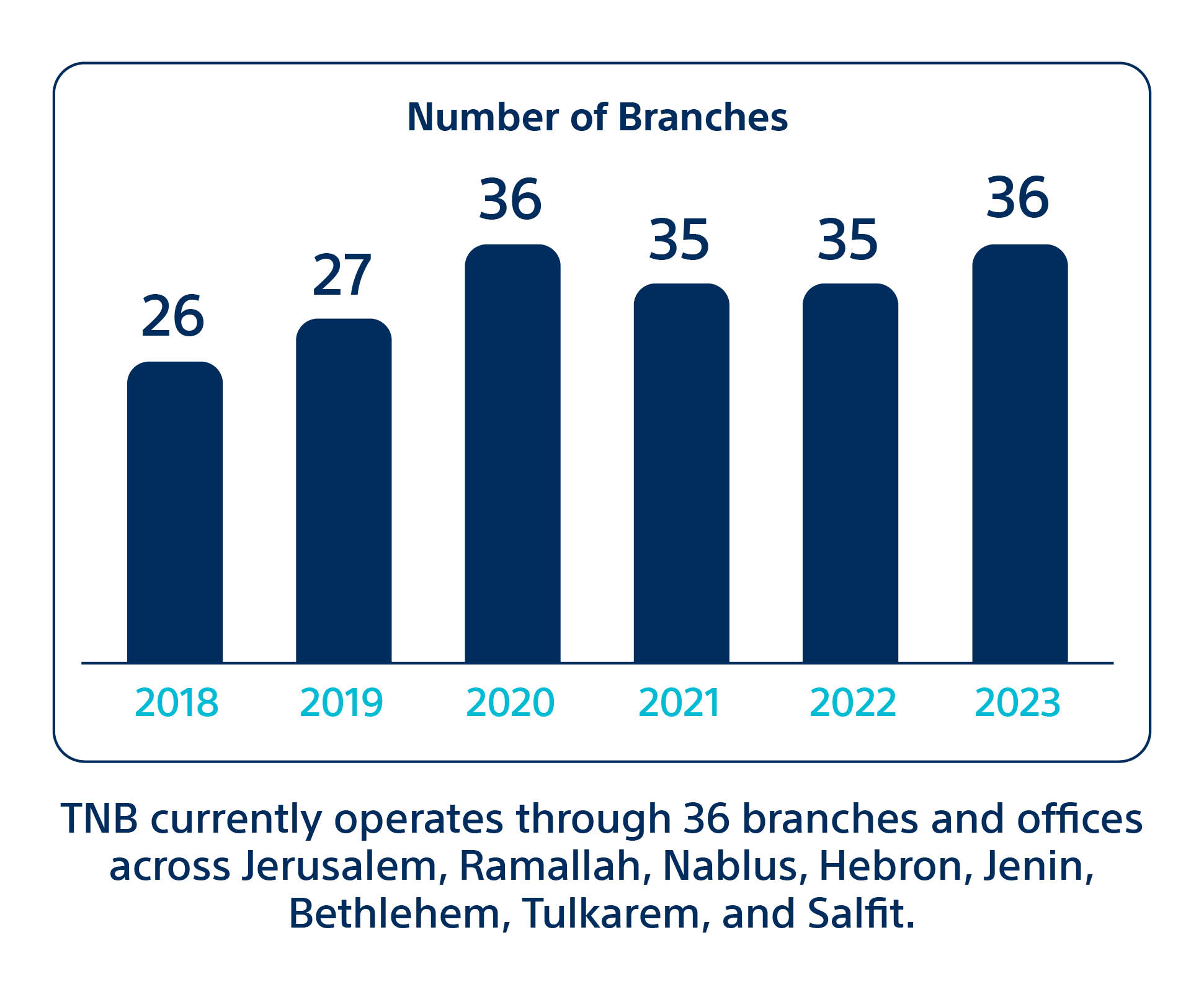

We also strengthened our geographical presence by opening a number of permanent and temporary offices to deliver our national banking services to the largest possible number of Palestinians wherever they are. In 2024, we will open new branches and offices to expand our banking network to 38 branches and offices across the governorates of the West Bank.

Responsive Community Banking Programs

In 2023, we also launched several community programs to address the needs of Palestinians in light of the difficult economic circumstances. We mainly strengthened our support and financing of the SME sector in Palestine, which is the backbone of the local national economy constituting more than 90% of existing projects in Palestine. We signed a 50-million-dollar agreement with the European Investment Bank (EIB), to finance different economic projects that will move the national economy forward.

Future Plans

In 2024, we will continue to focus on achieving our strategic plan goals; We will continue to grow effectively and efficiently, develop our IT infrastructure and investments, and strengthen regulatory and corporate governance frameworks, while creating opportunities for success and sustainable development for our society. Our beloved Gaza will be the focus of our relief efforts in 2024, to address as much as possible, the repercussions of the war and the humanitarian situation there, in addition to supporting Palestinian families affected by the difficult economic situation resulting from the war across Palestine. We are determined to continue our success and achievements to ensure the growth of our institution and country and to push the wheel of economic and social development forward.

Samir Zraiq

Chairman of the Board

Dear shareholders,

This year brought unprecedented challenges after the war on Gaza, and its direct impact on the economic situation and the financial performance of companies and banks in the West Bank. Such challenges drove us to rearrange our priorities and implement emergency plans to adapt our actions to the unfortunate situation in our country.

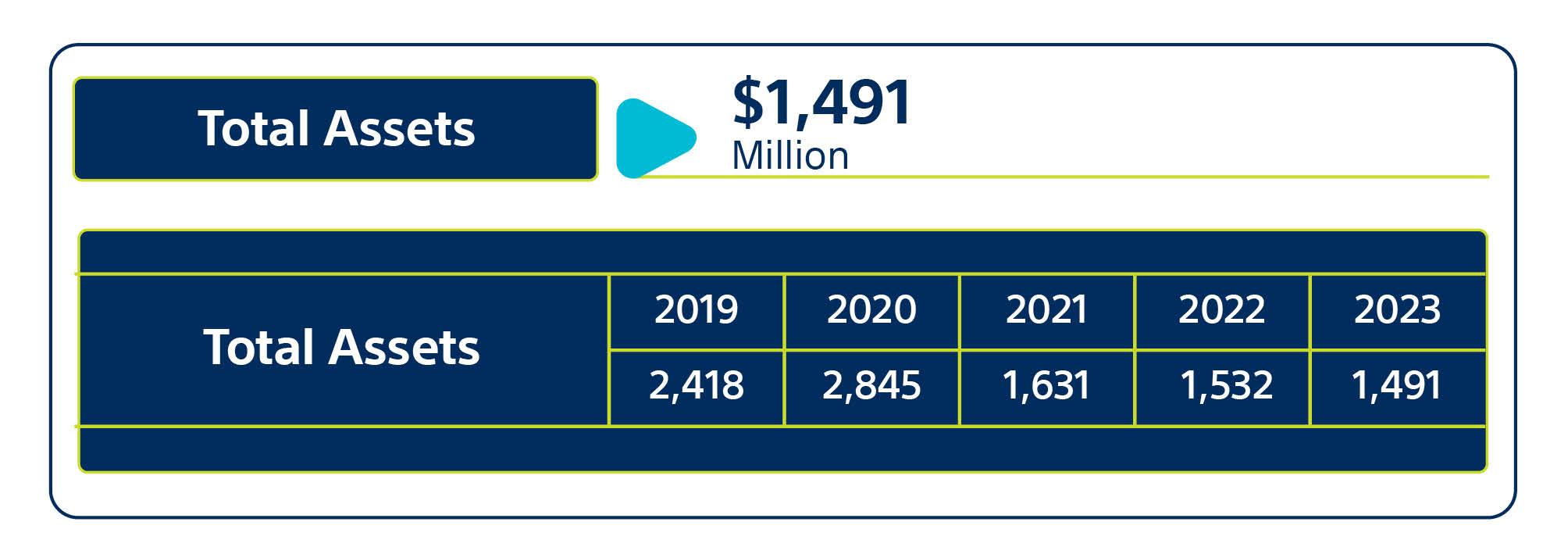

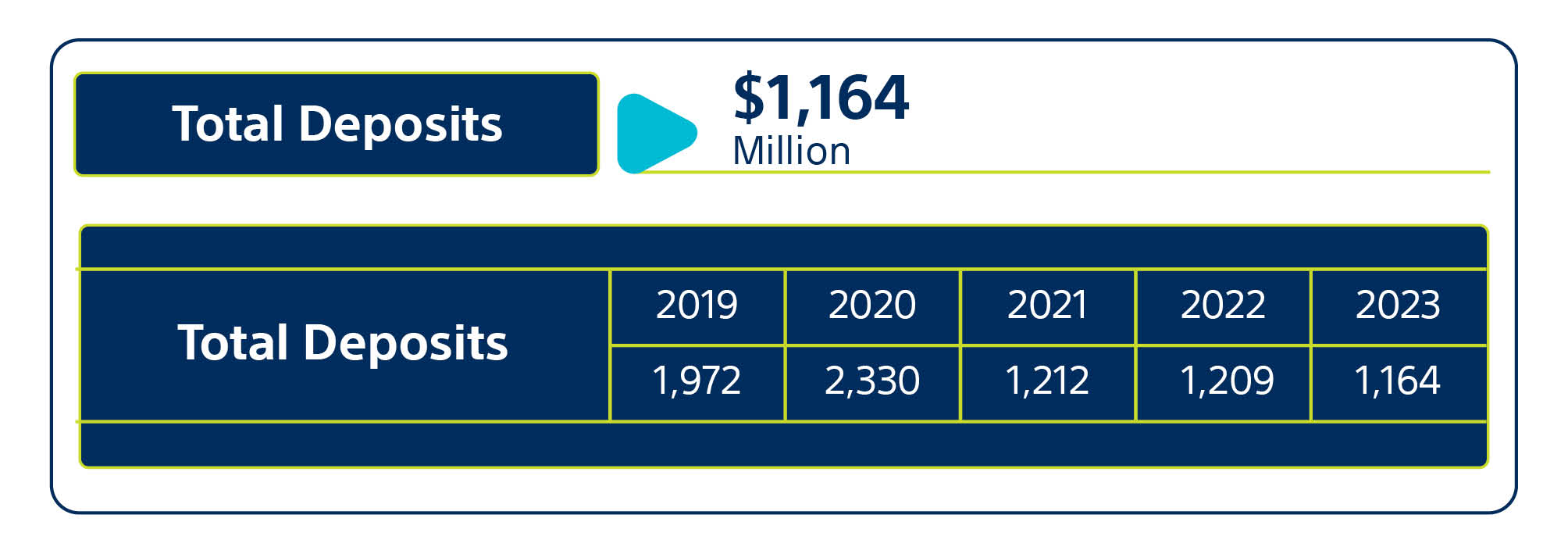

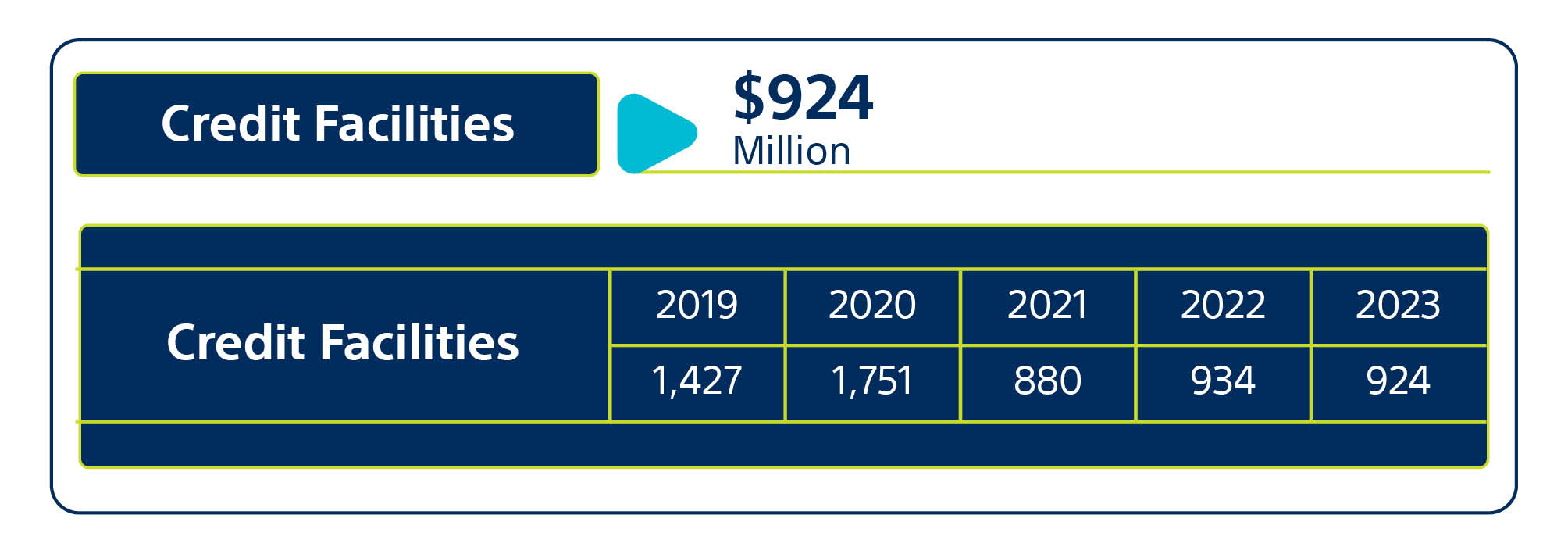

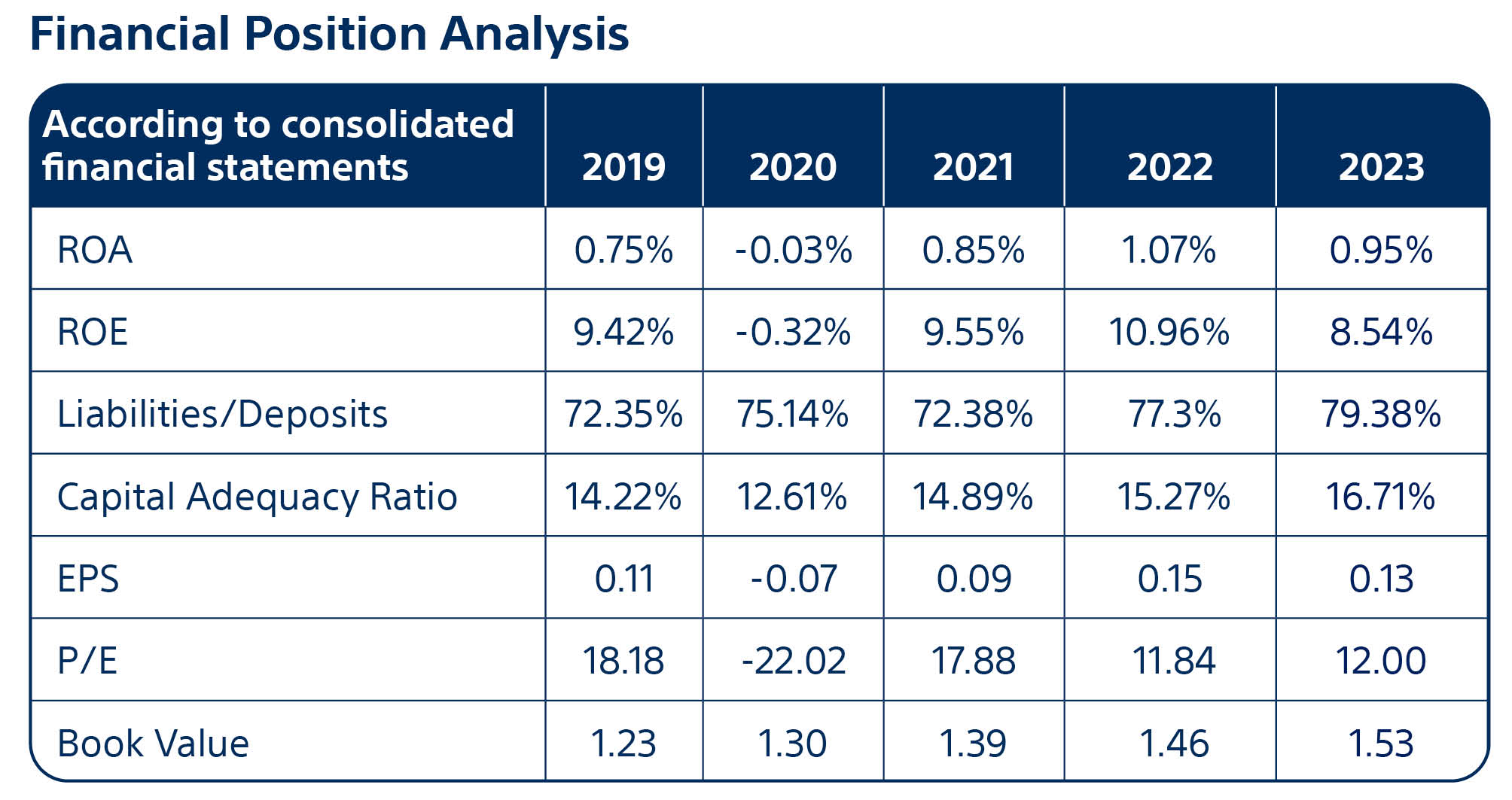

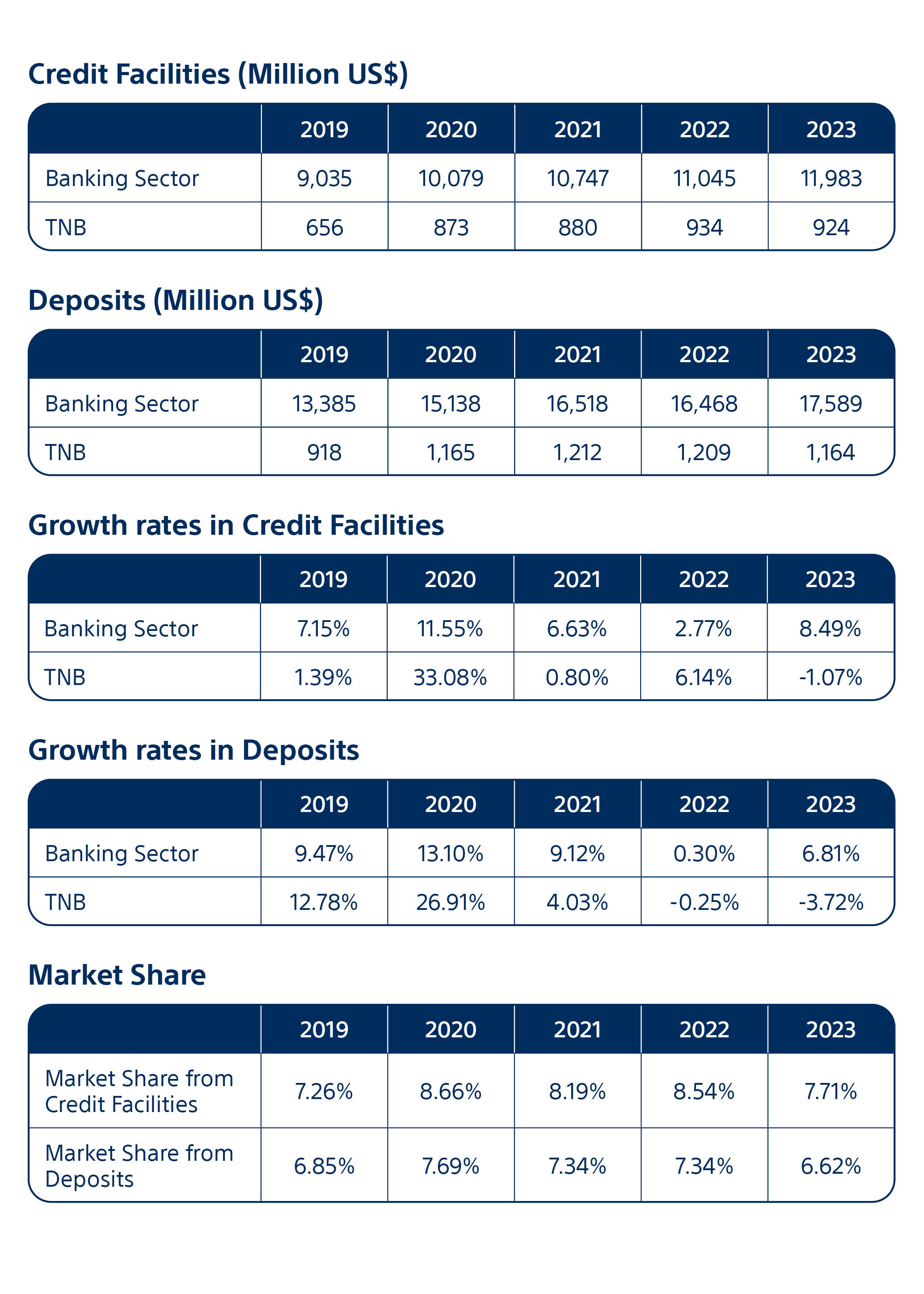

We quickly responded to the financial repercussions of the war. We enhanced liquidity, and increased our provisions and allocations, to protect our strong and sound financial position. By the end of 2023, TNB had achieved a net profit of US$14.4 million. Our assets amounted to US$1.49 billion, our customers’ deposits reached US$1.2 billion, and our direct credit facilities portfolio marked US$924 million. The capital adequacy ratio reached 16.71%, exceeding local and international requirements, which confirms our solid base and ability to respond quickly to any potential risks and protect our clients.

We also continued to implement our strategic plan goals, pumping millions of investments into digital technology. We prepared, in record time, to launch 15 basic and supporting systems with simulations. We successfully launched them at the beginning of 2024. In addition, we automated all banking services provided to retail customers in branches and completed the replacement and modernization of our ATM network. We now have a new more modern generation of ATMs, providing our customers with a unique and state-of-the-art banking experience.

In 2023, we centralized the archiving of customer data by establishing an independent centralized archive headquarters that would meet TNB’s need to keep customer records for a period exceeding 15 years. It operates through an advanced archiving system that facilitates the management and organization of the process to extract and keep transactions in safe custody. It is designed with the latest technologies to protect against damage and fire.

We are proud that during 2023, we were among the first banks in Palestine to issue our annual sustainability report (ESG Report), on aligning TNB’s 2022 environmental, social and governance work with the global Sustainable Development Goals (SDGs), by adopting the standards of the Global Reporting Initiative (GRI). We believe that integrating these principles into the work of companies will improve the institution’s effective performance, establish a solid foundation for its commercial and operational work, enhance its relationship with society by effectively responding to its needs, and establish solid rules of good governance.

We will continue, with determination, what we have begun to ensure the growth of TNB while supporting and developing our society. The circumstances we are witnessing today only increase our solid will to invest more in our nation and contribute to its social and economic development.

Salameh Khalil

Chief Executive Officer

TNB achieved a strong outcome because of its successful digital transformation strategy, designed to improve its competitiveness and bring about radical changes to start off strong in the coming years. TNB was able to lay a strong foundation for all its departments and cover all business aspects by restructuring its procedures to ensure excellence in implementation and service delivery. It also developed its technological infrastructure and digital channels to keep up with the latest developments in the labor market. TNB thus succeeded in regaining its competitive position in the financial market and proved its strength and durability in the banking sector, by achieving financial numbers and outcomes that exceeded expectations.

As part of TNB’s vision and objectives to achieve the best returns and provide better and more secure banking services to its customers and partners, it adopted a leadership and profitability strategy for the next three years 2023-2025, based on its vision to be the most pioneering, innovative, and robust bank by creating opportunities for success for the society as the most responsive bank.

To enhance information management, facilitate access to documents and record keeping, and improve the effectiveness of its internal operations, TNB opened an independent and centralized archive headquarters capable of keeping documents for a period exceeding 15 years. The headquarters is in a strategic location in Ramallah and is twice the size of the three old sites spread across 2,000 square meters. It accommodates around 10,300 shelves and approximately 20,590 portfolio boxes. The site is equipped with a highly advanced archiving system, the latest security and surveillance technologies, and special fire extinguishing systems.

The National Bank opened three cash offices in the courts of Jenin, Tubas and Halhul to promote its joint efforts with the Supreme Judicial Council and facilitate financial procedures for citizens brought before the Palestinian judiciary. TNB is now present in 11 Palestinian courts out of 13. This step reinforces its commitment to providing banking services to the largest possible number of Palestinian citizens.

The National Bank issued its first annual sustainability report on aligning TNB’s 2022 environmental, social and governance work with the global sustainable development goals by adopting the standards of the Global Reporting Initiative (GRI).

The report revealed several exceptional indicators, including a 10% increase in TNB’s reduction of greenhouse gas emissions compared to 2021, and a 10% reduction in electricity consumption compared to the same year. TNB relies on renewable energy sources to cover 64% of its operations. Other positive indicators included the percentage of female employees in TNB which reached 40%.

TNB has completed its project to modernize its ATM network by replacing all ATMs with the new DN Series generation, as part of its effort to provide state-of-the-art technologies and innovative banking services to its customers. This generation of ATMs offers advanced digital banking services through a touch screen and a display that provides an enhanced user experience. The new ATMs are in line with TNB’s future vision of digital transformation. They also feature currency recycling and take into account the special needs of the blind and visually impaired.

In 2023, a project was completed to fully automate services provided to customers in branches. A system was developed to facilitate the flow of internal operations between various departments and sections to organize and track customer requests and reduce response time. This also reduces the use of paper transactions. New services were added to the system, including: deposit linking, pricing and implementation requests, corporate onboarding, and loans of all kinds. In 2023, the procurement system was linked to the new system in various departments and branches of the bank.