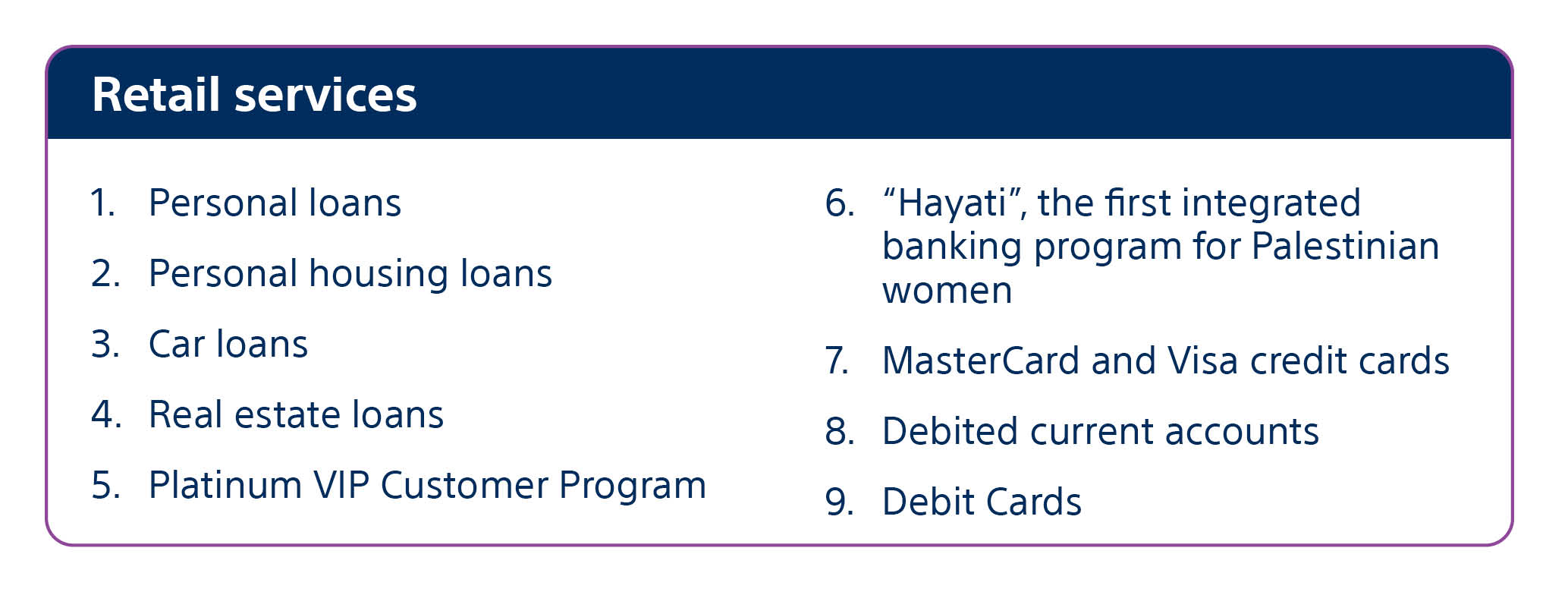

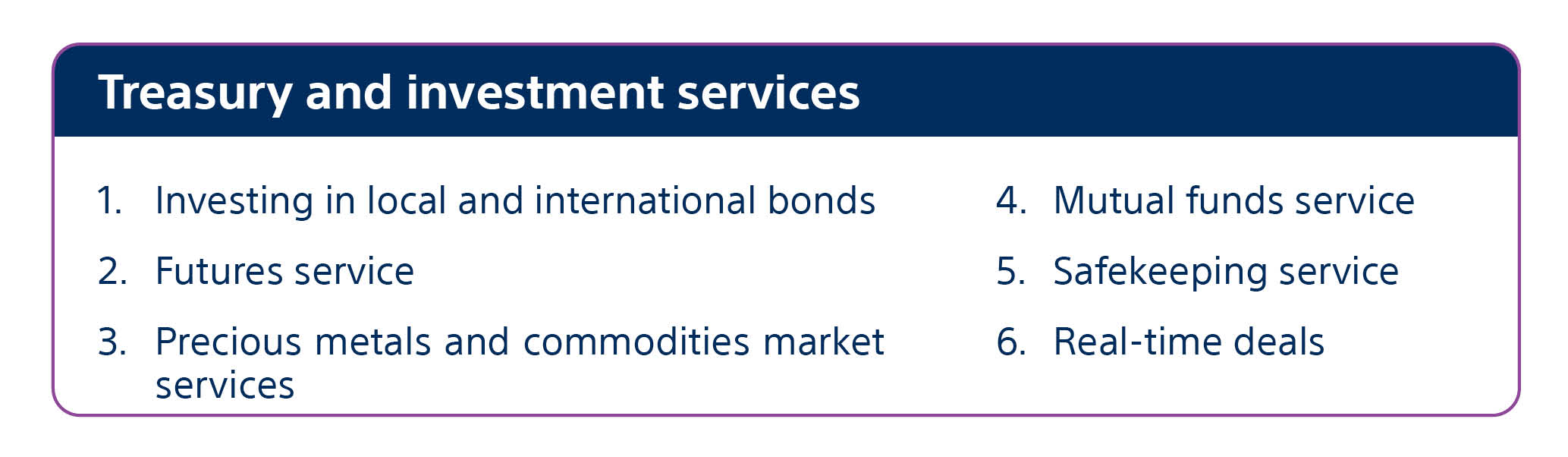

The National Bank seeks to provide comprehensive, quality and advanced banking solutions to all economic sectors, including commercial, retail, investment services and treasury. It also provides financing to small and medium projects, through its various departments and specialized, experienced and professional staff who seek to provide the best quality service to customers to meet their needs.

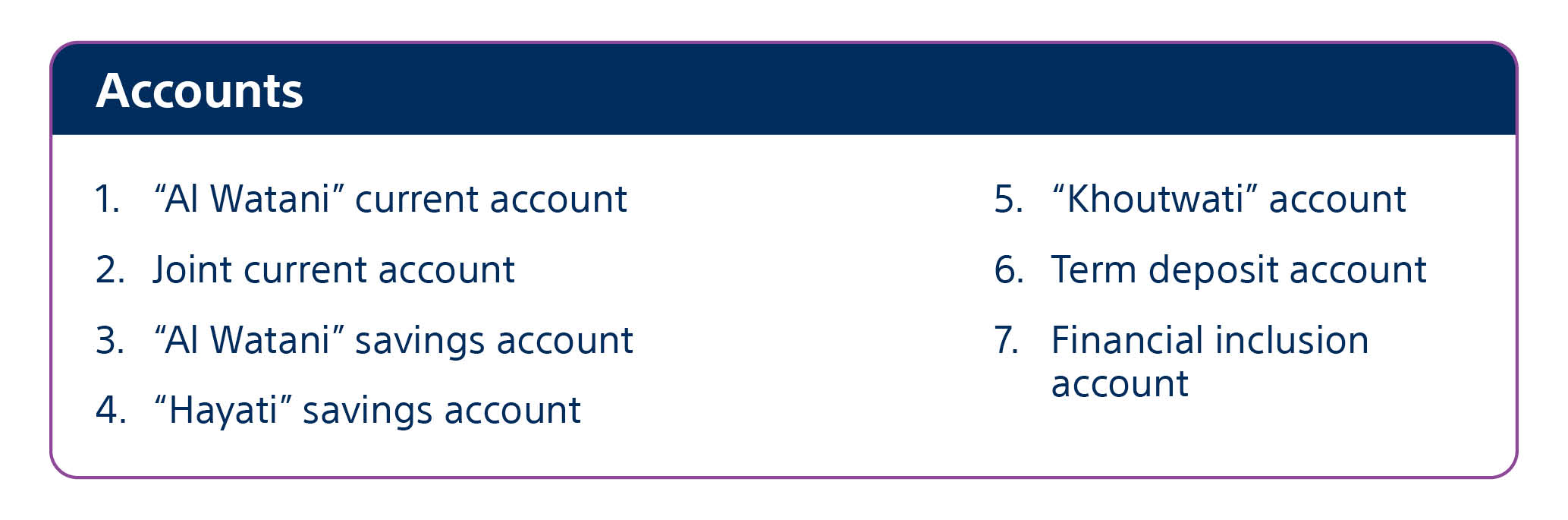

“Al Watani” Savings Account is designed for all Palestinian individuals of all ages. Its goal is to provide a safe place for savings and encourage individuals to save whatever they can today on a regular basis, to find it tomorrow when in need.

“Khoutwati” is a children’s savings account from The National Bank designed specifically to encourage parents to save for their sons and daughters from the day they are born until they are 17. The goal is to provide a safe place for savings and encourage parents to save what they can today, on a regular basis, so their children can find it tomorrow when in need, thus providing them with a better future.

In line with The National Bank’s policy, which aims to provide exceptional new services to customers and improve the quality of banking services and solutions, TNB created a “Platinum” department and designed a special program for VIP customers so that its elite customers can receive the utmost attention and care. They are offered exceptional professional and quick banking privileges and services which meet their personal and financial requirements.

Internet banking (Al Watani Online)

TNB offers the “Al Watani Online” internet banking service, which provides a unique electronic banking experience, with a modern design and various features. It facilitates electronic banking transactions in a quick and smooth manner and allows customers to access their bank accounts from anywhere and at any time, without the need to visit a branch and with the highest standards of security and privacy.

Mobile banking (Al Watani Mobile)

TNB offers mobile banking services to its customers through the “Al Watani Mobile” application, which provides a unique electronic banking experience on the mobile phone. It has a modern design and is easy to use and uncomplicated. It includes various features to facilitate electronic banking transactions, in a quick and smooth way via a mobile phone. It also allows customers to access their bank accounts from anywhere and at any time, without the need to visit a branch, and with the highest standards of security and privacy. The application is available on Google Play and the App Store.

A set of services and products have been developed and are offered through mobile banking and internet banking to keep pace with customer needs. Such services include:

Electronic Statement of Account

Through this service, customers can obtain a monthly statement of account for their bank accounts at TNB, without the need to visit a branch. The account statement is sent by email to the customer’s email address registered with TNB.

Cardless use of an ATM

The Cardless service, or the use of an ATM without a card, is the first of its kind in Palestine allowing customers to benefit from ATM services without the having to carry an ATM card.

This service solves the problem of customers forgetting their card, or when they need to use the ATM in an emergency. TNB’s customers can, through this service, perform simple banking operations through ATMs, such as a balance check, cash withdrawal, and cash deposit in ATMs. They can also request a mini statement and transfer between accounts, without the need to carry a card.

Electronic loan application

Customers can learn more about various types of loans and submit a loan application without the need to visit the branch. This can be done by filling out the special form and sending it to TNB. A bank employee will communicate with the customer, determine the type of loan that suits their financial needs, and provide the relevant details.

Send an electronic request for a checkbook

TNB allows customers to request a checkbook electronically through its internet and mobile banking services, without the need to visit a branch. The service has several features:

Electronic bill payment

TNB offers an automatic payment service, which is a digital service that is activated for free through the National Mobile application or online banking, to allow customers to pay their bills at any time and with ease. The due bills are paid directly from the customer’s account and the funds are transferred to the service provider’s account. This is done with the highest standards of security and privacy to maintain the confidentiality of data and transactions.

The e-Sadad platform was recently launched. It is a new digital payment solution by TNB. It relies on a central system subject to the supervision and management of the Palestine Monetary Authority. The new platform allows the display and payment of bills automatically through TNB’s electronic channels. It was designed to provide the customer with a unique banking experience to facilitate the payment of bills and fees. Through this platform, customers can pay their bills in full or in part through the “AlWatani” Mobile application or online banking quickly and smoothly, either once, or automatically and continuously.

Digital Onboarding

Through this service, individuals can open a new bank account electronically with TNB wherever they are, thus reducing the time and effort needed for opening an account in a branch.

The Digital Service Center

Through the Digital Service Center, customers can communicate directly with TNB staff from wherever they are, and at any time, without the need to visit the bank’s branches. The center’s staff members are dedicated to answering questions and enquiries from clients and shareholders and providing banking services, without reliance on traditional chat robots, through social media platforms such as Facebook Messenger, WhatsApp, email, or the bank’s website.

As part of its strategic plan for digital transformation, TNB pushed its customers to resort to electronic services, channels and social media platforms for their banking transactions instead of going to branches. In fact, 85,808 customers were served digitally in 2023, a 2% increase compared to 2022. In 54% of the cases, the service was provided though TNB’s WhatsApp account. In terms of excellence in service delivery and quality, the customer satisfaction rate reached 4.5/5.

Contact address for the Digital Services Center

Send and receive money safely and quickly through the Western Union service from The National Bank. This service allows you to send and receive money without an account and from anywhere in the world.

In order not to waste time and effort, The National Bank provides you with a service for paying taxes in its branches across Palestine.

Do not worry about your valuables and important documents. You can keep them in safe deposit boxes provided by TNB. The deposit boxes have a high-security system, are designed in different sizes to suit the needs of all customers and are affordable.

“Luxury is your choice” is TNB’s slogan for the MasterCard World Elite credit card. It is offered to elite customers and features a set of exclusive benefits and services tailored to meet the aspirations of elite customers and to give them the lifestyle they deserve.

The elite customer and VIP service staff at TNB follow up on the MasterCard World Elite card to ensure a unique experience for customers wherever they are. Customers no longer need to visit a branch and are kept informed of the latest exclusive benefits and offers to benefit from all the advantages the card has to offer and enjoy financial power that exceeds their expectations!

TNB Visa Signature card gives you many benefits and advantages that suit your lifestyle and enrich your travel experience wherever you go around the world!

The Visa Signature card is the perfect travel companion with exclusive benefits and rewards for cardholders. It presents you as a privileged customer wherever you use it. Enjoy benefits including travel insurance for multiple trips, purchase protection, emergency medical and legal referrals, and global customer assistance services. It also provides 24/7 customer service to ensure your peace of mind when you use it while traveling.

MasterCard “Platinum”

The MasterCard “Platinum” card was specially created to keep pace with your lifestyle and give you luxury. It allows you to access the finest and best services easily and conveniently from anywhere in the world. It gives you a package of exceptional benefits and options for travel and shopping. It also gives you access to business lounges in several airports in the Middle East.

The MasterCard “Platinum” card was specially created to keep pace with your lifestyle and give you luxury. It allows you to access the finest and best services easily and conveniently from anywhere in the world. It gives you a package of exceptional benefits and options for travel and shopping. It also gives you access to business lounges in several airports in the Middle East.

(الفضية، الذهبية)

Al Watani MasterCard cards are one of TNB’s automated channels operating 24/7 from anywhere in the world. They allow you to access multiple banking services to withdraw cash from ATMs or pay for your purchases and services locally and internationally on the internet and at different points of sale.

The debit card is an ATM card and a shopping card at the same time. There is no need to carry your cash with you everywhere, as you can use your TNB “MasterCard” debit card. You can go to more than 700 ATMs of different banks in Palestine and use the Al Watani key “194” to withdraw cash without any commission. You can also use the card locally and around the world through points of sale and ATMs that have the MasterCard logo.

يقدم البنك الوطني التطبيق الابتكاري TNB Rewards لمكافأة عملائه من مستخدمي بطاقات البنك الوطني الائتمانية الفضية والذهبية وبلاتينيوم، والذي يتيح لمستخدمي البطاقات تجميع نقاط مكافأة عند كل استخدام للبطاقات الائتمانية - سواء حركات المشتريات عبر أجهزة نقاط البيع أو أي من حركات التسوق عبر الإنترنت، بالإضافة إلى التمتع باستبدال النقاط عبر مختلف القنوات الإلكترونية في أي وقت ومن أي مكان حول العالم.

تماشياً مع سياسة البنك الوطني والتي تستهدف تقديم خدمات متميزة وجديدة للعملاء وللارتقاء بجودة الخدمات والحلول المصرفية لأعلى المستويات، عمل البنك على إنشاء دائرة "البلاتينيوم" ليحظى عملائه النخبة المميزين بأقصى درجات الاهتمام والتقدير عن طريق تقديم مجموعة من الخدمات الاستثنائية التي تلبي متطلباتهم الشخصية والمالية بصورة مهنية وسريعة.

حياتي | برنامج المرأة الفسطينية

قام البنك الوطني خلال عام 2017 بإعادة إطلاق برنامج "حياتي" وتحويله إلى برنامج مصرفي متكامل مخصص لتلبية الاحتياجات المالية الشاملة للمرأة الفلسطينية ليكون بذلك الأول من نوعه في السوق المصرفي الفلسطيني. بحيث يقدم البرنامج كافة الخدمات البنكية والتي تشمل الحسابات بأنواعها وكافة أنواع القروض بالإضافة إلى البطاقات الائتمانية والدفع المباشر، بتسهيلات مختلفة على هذه الخدمات وأسعار فوائد تفضيلية بالإضافة إلى تمييز المشتركات بدفاتر شيكات وبطاقات بتصاميم خاصة تحمل لون وشعار البرنامج.

In early 2023, TNB launched a special campaign for savings accounts with valuable prizes to ensure financial security for savers and their families. The campaign included valuable prizes such as: the grand prize, which is a house, a ten-year salary, and a car, granted to two winners with two draws a year. There was also a monthly cash prize of 100,000 shekels, two ounces of gold for weekly winners, and a gold ounce for a daily winner.

The campaign targeted all segments of society, including women, men and children. It covered all types of savings accounts at TNB. All savings accounts were eligible to enter the draws, provided they have a minimum of 200 US dollars or its equivalent in other currencies. Every additional 200 dollars is an opportunity for a new entry in the draw.

In 2023, a special campaign was launched to defer installments for individual borrowers. The campaign went on for more than five months and aimed at reducing the burden of installments during the holy month of Ramadan and the holiday season. It allowed for the postponement of up to 4 consecutive installments for all types of individual loans without a deferral commission.

This is a special banking campaign for Palestinians living in the 1948 territories that gives workers exceptional advantages on accounts, loans and cards without having to transfer their salary to TNB. The campaign includes a set of fast and flexible services and credit facilities for workers at competitive interest rates. Facilities vary and include all types of individual loans, credit cards at zero issuance fee for the first year, and no commission debt purchasing for all types of loans.

The campaign also includes account features, such as a two-year exemption from the current account management commission, a free check book, and an exemption from the commission for issuing three direct payment cards for the account. In addition, every worker who took a loan during the campaign can enter a draw for two prizes worth 4,000 shekels for two winners per month.

This is a special campaign for TNB customers to encourage them to pay the annual fees to the Ramallah Municipality electronically, by using their TNB direct payment cards (ATM cards). The campaign was launched in cooperation with the municipality as part of a national campaign to encourage electronic payment. In the campaign, five winners will be drawn to win a cash prize of $200 each.

This is a special campaign for TNB customers to encourage them to make cashless payments for fuel at gas stations. The payment can be made easily and securely using a direct payment card (ATM card) from TNB without any additional commissions to encourage electronic payment. In this campaign, ten names will be drawn to win ten cash prizes worth 500 shekels each.

In 2023, TNB renewed its strategic partnerships with major international and local institutions, including:

TNB and the European Investment Bank renewed their cooperation to support small and medium enterprises in Palestine, by providing flexible loans at reduced interest rates to this sector, which represents 95% of the total projects in the country and is the backbone of the Palestinian national economy. The cooperation focuses on providing financing to startups and encouraging women-owned and youth-owned initiatives.

The National Bank and the Palestine Pension Fund Authority renewed their strategic partnership and the safe deposit agreement to manage the Authority’s financial portfolio and assets. Under the agreement, The National Bank provides custody services for all the Authority’s funds and properties and informs it of all procedures related to interest, profit, and rights accruing to its financial and investment portfolios. It also manages any liquidity and cash surplus in line with the Authority’s instructions and investment policy, under the supervision of specialized professionals who have extensive experience in this field, to ensure that funds are managed in an effective and optimal manner for Palestinian retirees.

TNB and the Palestinian General Federation of Trade Unions signed a strategic cooperation and partnership agreement under which TNB provides a range of banking services and facilities to the Federation and its members. As part of this agreement, TNB provides a variety of banking services to the Federation, and grants privileges on facilities, deposits, money transfers, and other banking services. In addition, TNB provides financial advisory services to the Federation through a specialized team which stands ready to advise on any financial decision.

TNB renewed its partnership with the Syndicate of Dentists by signing a joint cooperation agreement under which TNB provides a variety of banking facilities for the Syndicate and its members. Such facilities include housing loans, real estate and land purchase loans, real estate financing facilities, personal loans, and car loans, in addition to facilities for equipping their clinics, and special benefits on cards and accounts.

In 2023, The National Bank renewed its strategic partnership with the Palestinian Bar Association by signing a joint cooperation agreement. Under the agreement, TNB manages the Association’s funds and accounts, and provides a set of banking privileges and services that meet the financial and banking needs and aspirations of the Association.

The Ministry of Education and TNB signed a cooperation agreement to manage the Social Solidarity Fund accounts of the Ministry’s employees. As part of this agreement, TNB provides a set of privileges for deposits to the Fund and financial and banking services, including electronic services specifically designed to provide preferential benefits to the Ministry of Education.

TNB and the Palestinian Banking Corporation signed a partnership agreement to ensure banking cooperation. The agreement will allow the Corporation’s customers to pay their monthly installments through TNB.

The National Bank and Istiqlal Bank for Investment and Development signed a strategic cooperation agreement. The first phase includes managing the development facilities portfolio, as part of an effort to develop a comprehensive relationship between the two banks. Under the agreement, TNB manages Istiqlal Bank’s credit facilities portfolio to provide development loans to support the agricultural and livestock sectors, the green economy, technology and digital transformation, leadership and innovation, and the industrial sector.

The National Bank and Middle East Payment Services /Palestine (MEPS) signed a cooperation agreement that allows TNB’s customers to benefit from point-of-sale (POS) services and pay for their purchases electronically in stores. Under the agreement, MEPS Palestine supplies, operates and installs POS devices for TNB and distributes them to shops owned by TNB customers in various areas of the West Bank, allowing them to receive payments via all types of local and foreign payment cards.

The National Bank has been actively working since 2015 to promote the financial inclusion of Palestinian women. It introduced the first savings product specifically for women and granted US$3.5 million worth of loans for women-led projects without interest, to promote women’s role in the economy. TNB strives to reach Palestinian women with its financial programs and banking awareness, especially in rural and marginalized areas.

In 2023, TNB made tangible progress in promoting financial inclusion for women, with women accounting for 32% of its total clients. By the end of 2023, the percentage of women who own current accounts reached 21% while the percentage of women who own savings accounts reached 41%.

Presenting the experience of The National Bank and its contribution to innovation and banking technology to promote the financial inclusion of Palestinian women

To promote “Innovation for Gender Equality,” The National Bank participated in the “Bell Ringing” ceremony organized by the Palestine Stock Exchange with its partners UN Women, the International Finance Corporation, and the Palestinian Capital Market Authority. Discussions in the sessions focused on bridging the gender gap by providing digital electronic services and shifting towards innovation and digitization to develop national policies and provide services. The sessions also presented the experience of some companies from the Palestinian private sector, including TNB, and their contributions in this field.