The National Bank is committed to the highest standards of good governance, and work is carried out in accordance with the PMA’s Governance Guide and instructions No. 10/2017.

The relationship between the bank’s management, represented by its Board and executive management, and the shareholders is based on a framework that ensures the implementation of sound management and governance in achieving its objectives and realizing various benefits for stakeholders, including minority shareholders. The governance system provides detailed, accurate and timely information about TNB and the responsibilities of the Board and its different committees towards the bank and shareholders.

The National Bank is committed to sound governance practices and the highest standards of efficiency and accuracy in its activities in line with PMA instructions which are in line with the latest international best practices and the Basel Committee recommendations on governance.

The bank is committed to meeting the needs of the Palestinian community by providing banking services using the most modern and sound methods and ensuring services are provided in a proper manner to different stakeholders. Additionally, the bank supports the community by sponsoring different social activities. This promotes its national affiliation and identity and is a part of its social responsibility.

A prominent local and regional businessman and economist, with wide investments in several sectors in Palestine and abroad, Zraiq has extensive experience in economic policy design, asset and portfolio management, and financial and strategic planning.

Mr. Samir Zraiq is the Chairman of the Board of Directors at TNB, the fastest growing bank, and he has been dedicated to raising the standards of financial services in Palestine. His relationship with TNB goes back 10 years, as he has been a member the Board since 2012. He chaired the credit committee and was a member of the investment committee. Because he believes in the bank and its ability to raise the standards of financial services in Palestine, he invested by purchasing a stake which made him one of its major shareholders.

Zraiq is the Chairman of the Board of Palestine Investment & Development Company PID, a public shareholding company listed on the Palestine Exchange. It is the first holding company established in Palestine and it works in various investments fields, including real estate, financial, educational and other commercial investments.

Zraiq is also the Chairman of the Board of Directors at Sahem Trading & Investments, a leading Palestinian brokerage and investment services company. He led the company to become one of the most highly ranked in terms of market share in the Palestine Stock Exchange, strategic partnerships, research services, and issuance management. He supervised the investments of a large group of private companies in the financial and real estate sectors, based on his investment experience which combines excellent knowledge and unique skills, and led many companies on the path of excellence and distinction.

He chaired the Board of Directors of the Federation of Palestinian Businessmen Associations, the Palestinian Businessmen Association in Jerusalem, and was the Vice- President of the Federation of Arab Businessmen. He is passionate about sustainable development in the Palestinian private sector and has worked towards promoting economic activity and designing national economic policies.

He was a member of the National Economic Development Team in Palestine, a Board member of the Social Security Fund and the Chairman of its Investment Committee. He was also a member of the national team responsible for Palestine’s bid to join the World Trade Organization, a Board member at the Supreme Council for Creativity and Excellence, and the Chairman of the Board at the Young Leaders Foundation (YPO).

Mr. Omar M. Masri is a businessman with over 30 years of experience in the banking and energy sectors. Since 2006, he has been the Group Managing Director of the Edgo group, a regional company with operations in the fields of oil & gas, power, water, and infrastructure. Prior to Edgo, Omar established and managed Atlas Investment Group (“Atlas”) in 1996, a regional investment banking firm, and in 2004, the Arab Bank acquired Atlas and established it as the bank’s Investment Banking arm, known today as AB Invest. He was appointed as Arab Bank’s first Global Head of Investment Banking and represented Arab Bank on the boards of several affiliate and sister entities, including the Arab National Bank in Saudi Arabia. He was the first individual in Jordan to be granted the Certified Financial Consultant, Broker, and Investment Manager License by the Jordan Securities Commission. In 2004, Omar was invited to be a member of the Dubai International Financial Exchange (DIFX) Practitioner Committee to assist in the establishment of the Dubai International Financial Centre (DIFC)’s DIFX operation.

In 2002, Omar founded the Chartered Financial Analyst (CFA) Institute’s Jordan chapter and became its first chairman. Prior to establishing Atlas, he was a fund manager at Foreign & Colonial Emerging Markets in London, UK, where he structured and managed the first regional Middle East investment fund in the world, which was listed on the New York Stock Exchange.

Omar has a B.B.A. in Finance from the George Washington University in Washington, DC. In 1990, he completed a two-year, intensive wholesale credit-training program at the Philadelphia National Bank/Wharton Business School in Philadelphia and subsequently managed the bank’s correspondent banking relationships in Thailand and Japan. Omar has been a member of the Young President’s Organization (YPO) since 2001 and was selected as a Young Global Leader by the World Economic Forum.

Mrs. Masri is a board member in many leading companies of the private and public sectors in Palestine. She is known for supporting charitable causes and initiatives that promote cultural sustainability and empowerment of Palestinians in various sectors through the Munib Rashid Al Masri Foundation for Development.

In the nineties, Masri worked for Manufacturers Hanover Bank in New York for 3 years and then moved to the UK to manage the family business. In 1995, she relocated to Palestine to help her family in the establishment of many companies in various sectors, which include consumer goods, beverages, construction, and car trading companies.

Masri obtained a Master of Business Administration and a Bachelor of Science in Environmental Studies from George Washington University, USA.

A businesswoman with extensive experience in executive business, Zraiq is a skilled communicator and has proven her team building and employee development abilities. She currently occupies several positions in several private Palestinian companies in various fields. She is currently the Chairwoman of al Mustaqbal School, a member of the Board of Directors of the Arab American University, the Chairwoman of Zoom Advertising and a board member of Sahem Trading & Investments. She is also a board member in publicly traded companies such as the National Bank (TNB), and Palestine Investment & Development (PID).

For over 25 years, Ms. Zraiq has played a pioneering role as Partner & CEO of Massar International Group investment projects, Siraj Fund Companies, and Bayti Real Estate Investment Company (the developer of Rawabi City). In 2016, she founded the Rawabi English Academy. She also served as a member of Rawabi Municipal Council for two consecutive terms. She has provided financial and administrative oversight for new business initiatives in journalism, IT, financial services, real estate, and media.

She was a founder and the first chairwoman of the Palestinian Businesswomen Forum and remains a member of its Board. She is a Board member of Partners for Sustainable Economy and a Board member and former Chairwoman of the Board of Directors at the Young Leaders Foundation in Palestine. She was appointed by the former Prime Minister, Dr. Rami Hamdallah, as a member of the Board of Directors of the Loan Fund for Undergraduates in Palestine for 2017-2021. She is also a member of the Executive Board and a member of the Board of Trustees of the Global Arab Investor Forum.

In addition, she is a fellow of the ASPEN Global Leadership Network (AGLN). In 2013, Zraiq earned the Vital Voices Global Leadership Economic Empowerment Award. In 2022, she received the (Global Impact) award for the Middle East from the Young Leaders Foundation (YPO) for her initiative “Investing in Education and Empowering Youth”. She also participated in many local and international conferences.

A respected figure within the regional financial and insurance sectors, Zurub brings over 20 years of relevant industry experience in which he spearheaded multiple companies and federations, both in Palestine and Jordan. As CEO and board member of AlMashreq insurance company and executive manager and board member of the Jordan French Insurance Company, Zurub lends unique insights to cement the abovementioned institutions’ standings as prominent market players. Among his contributions during his previous tenure as board member of the Palestinian Capital Markets Authority, he provided valuable knowledge to actively support the development of the Authority’s corporate governance. He is also an advocate for the digitalization of solutions in the financial sector; a risk management and mitigation specialist; and an expert on the impact of international financial reporting standards on financial services companies. Furthermore, he has established a number of logistics companies since 2003 and managed various projects across the region, including in Palestine. In 2014, he expanded into the real estate sector. He is now the Chairman of Alaqariya Commercial and Investment company.

Zurub is currently board member of Sadad, an electronic payment service provider, and many other companies in the financial services and investment sectors. He is the vice chairman of both Jordan Management and Consulting, a leasing and investment company, and Medservice, a leading medical third-party administrator. He previously chaired the board of the Palestinian Insurance Federation and was a member of the National Committee for Financial Inclusion.

Zurub holds a bachelor’s degree in Finance and Risk Management, from the University of Florida in the US.

Mr. Abu Khadijeh is the General Manager and main partner of Rasil Express (Fedex), Palestine. He has a rich experience and has worked in some of the largest and most reputable companies in Palestine. Between 2007 and 2012, he was the Deputy CEO and CFO at Paltel.

He was the CFO of Medical Supplies and Services, Unipal and the National Beverage Company/Coca- Cola in Palestine and led many important restructuring processes, purchases, sales and mergers.

He served as a Board member in several Palestinian companies such as Brico, Jericho Gate, Vitel and others. He is also a board member in some NGOs.

Abu Khadijeh holds a Master of Business Administration from the Kellogg School of Management, Northwestern University in Chicago, the USA.

The Chairman of the Board of Directors exercises all duties and powers granted to them by the laws in force in Palestine and the instructions of the Palestinian Monetary Authority. They also carry out the tasks and powers delegated to them by the Board. They shall separate between the positions of the Chairman of the Board and the Chief Executive Officer.

The Chairman of the Board of Directors has the following main roles:

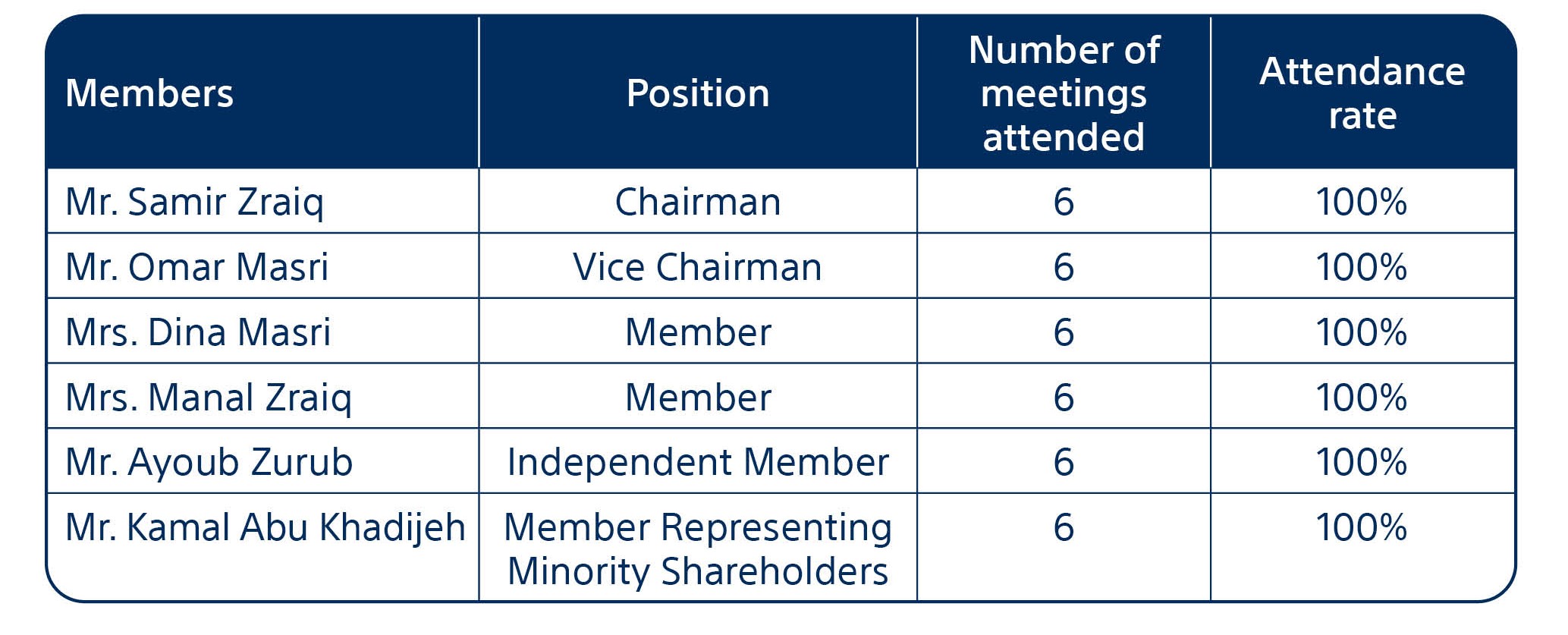

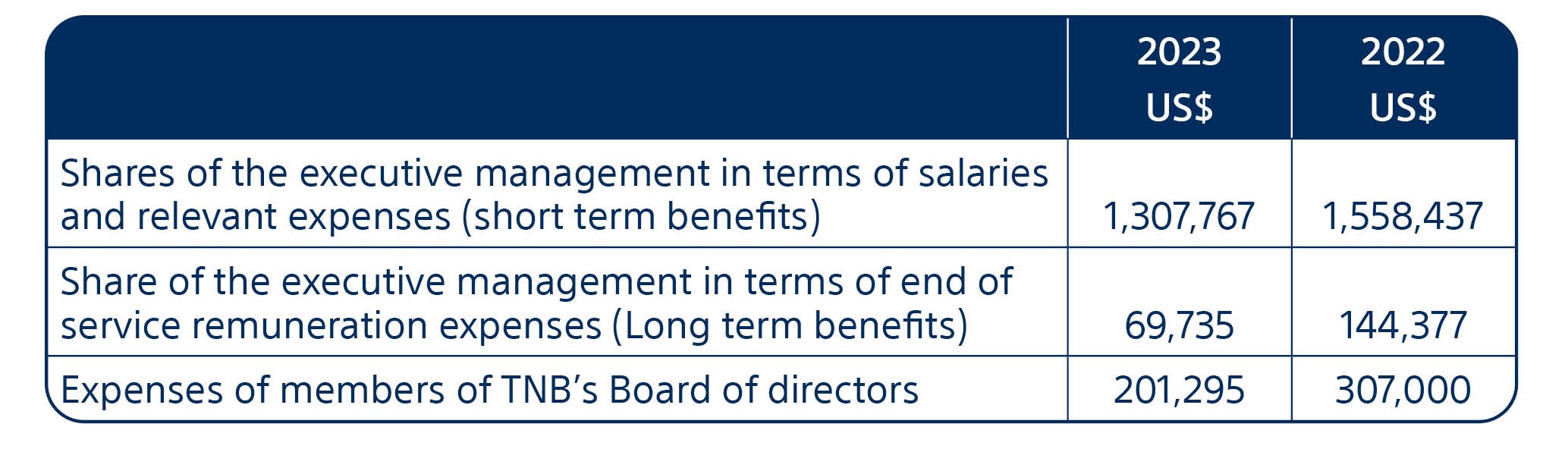

The bank complies with the Remunerations Committee’s recommendations in respect of the attendance allowance of members of the board, noting that they are annually determined as follows:

The board was restructured in 2017 to include three independent members and a representative of the minority shareholders, in line with corporate governance best practices and PMA’s regulation No. 10 of 2017, and in implementation of the PMA Corporate Governance Guide.

The National Bank seeks to create an effective, transparent and cooperative work environment. For this reason, it adopted rules and regulations for professional conduct and appropriate work ethics. On this basis, a conflict of interest policy has been prepared and approved by the Board of Directors to promote and protect those values. It will prevent any misuse which may create a conflict of interest. The policy aims to:

It is worth noting that in 2023, there were no voting abstentions caused by a conflict of interest, and no contracts or transactions involving conflict of interest were carried out.

تطبق سياسة تضارب المصالح على جميع الموظفين والمنتسبين للبنك الوطني لتكون مكملة- لا أن تحل محل - التعليمات والقوانين المعمول بها في الدولة والتي تحكم حالات تضارب المصالح.

وكجزءٍ من إطار عمل الحوكمة في البنك الوطني فقد قام البنك باعتماد سياسة حماية أصحاب المصالح من المساهمين والجهات الرقابية والعملاء والموردين والموظفين وأية جهة خارجية يتم التعامل معها بهدف ضمان احترام وحماية حقوقهم وفقاً للقوانين والتعليمات الصادرة عن الجهات الرقابية ذات الصلة.

إن الغاية العامة والأساسية من السياسة وهي وضع المبادئ والأسس الاسترشادية التي تحكم علاقة البنك مع أصحاب المصالح الذين تربطهم علاقة بالبنك وتمكينهم من رفع الشكاوى والتظلمات والتبليغ عن الممارسات المخالفة. وكما يضمن البنك حماية حقوق أصحاب المصالح فإنه بالمقابل يتوقع أيضاً وفاء أصحاب المصالح بالتزاماتهم التي تحكمها العقود والقوانين واللوائح الصادرة عن الجهات الرقابية ذات الصلة.

The Board of Directors of The National Bank declares that there are no special matters that may affect the continuity of the bank’s business and acknowledges and confirms the following:

All decisions taken in 2021 were made by a unanimous vote by the Board.

Mr. Salameh Khalil is a highly experienced executive with a career spanning over 20 years. His in-depth knowledge includes financial planning and strategy, risk management, treasury, internal controls, auditing, and accounting. Prior to his appointment as CEO of The National Bank (TNB), he was the Chief Financial Officer of Palestine Telecommunication Group (Paltel Group), he was responsible for managing the financial, administrative, human resource and procurement operations of the Group and supervising it, in addition to setting the strategic objectives of the Group within that scope. Mr. Khalil is a board member of various Group subsidiaries such as Jawwal, Jericho Gate Real Estate, Palvest, in addition to his board membership in TNB since 2013.

Before joining Paltel Group, Mr. Khalil was the Vice President of Finance of Bloom Holdings in the United Arab Emirates. His role included defining the Group’s financial strategies, treasury activities, financing the Group’s operations and projects, internal controls and preparing budgets and financial statements. Before working at Bloom Holdings, Mr. Khalil worked at Ernst and Young in Ramallah as an audit manager, where he managed the audit of leading corporates and international institutions including the European Commission, World Bank and USAID. in addition, Mr. Khalil also managed international projects for the Palestinian Ministry of Finance; consulted on audit and internal controls, budgeting, risk management and institutional capacity building for the sovereign institutional infrastructure.

Mr. Khalil obtained a Bachelor of Accounting from Birzeit University in 2000, and holds several additional accounting accreditations, including: Certified Public Accountant (CPA), Certified Internal Auditor (CIA), Certified Project Finance Specialist (CPFS) and Master Financial Controller (MFC).

Anan Zagha joined TNB as the Chief Financial Officer in late 2020. He started his career at Ernst & Young (EY) MENA - Palestine, where he was a Senior Audit Manager responsible for the largest companies listedin the Palestine Stock Exchange (PEX). Later on, he joined EY’s branch in Belgium to continue in his role as a Senior Audit Manager, where he also managed the audit of large listed companies, and supervised the audit quality for EY’s branches there.

With an experience extending for over 12 years, Anan has gained a vast knowledge in International Financial Reporting Standards (IFRS), internal control and monitoring systems, and coaching in the relevant fields.

He holds a bachelor’s degree in Accounting from Birzeit University, Palestine, as well as international accounting and finance certifications including Certified Public Accountant (CPA).

Haitham Najjar is the Chief Strategy Officer at TNB and has more than 14-years of experience in investment and strategic planning. He joined TNB in 2011 and held several positions including Investment and Financial Institutions Department Manager and Strategic Planning Department Manager. Najjar played an important role in managing and planning the bank’s Merger and Acquisition transactions, including: the merger with the Arab Palestinian Investment Bank (APIB), the acquisition of Bank Al Etihad, the acquisition of JCB, and the acquisition of a majority stake in the Palestine Islamic Bank (PIB), where he also managed building synergy between TNB and its affiliate PIB.

Prior to joining TNB, Najjar worked for two years as a Research Manager at Sahem Trading and Investment, where he was responsible for issuing initial specialized investment analysis reports for the Palestine Stock Exchange. Najjar’s experience also extends to academia: in 2009, he was a lecturer in financial management at the Department of Economics at Al- Najah National University.

Najjar started his career in the Hashemite Kingdom of Jordan. He worked for four years at Palestine Development and Investment Company (PADICO) and Tanmia Securities Company, consecutively, as a Senior Financial Analyst, Investment Consultant, and Financial Broker.

Najjar holds a master’s degree in Administrative and Financial Sciences from the New York Institute of Technology, and a Bachelor’s Degree in Finance and Banking from Al-Najah National University, Palestine. Najjar is also one of the first individuals in Jordan to obtain a Certified Financial Planner (CFP) certification by the Jordan Securities Commission.

A well-known local banking expert, with a diversified banking experience of more than 24 years in the Palestinian system. Mr. Dahadha’s expertise is diverse and includes: Credit facilities for retail, strategy development, designing banking products, studying and analyzing markets and customer behavior, and sales management. He also has administrative experience in regional branches.

He started his career in 1997 working for the regional department of the Arab Bank in Palestine. He left a clear mark when he contributed to the establishment of the first retail department in the Palestinian banking system in 2004 and built the bank’s retail department in 2008.

He was promoted several times and held important administrative positions at a young age, mainly Director of sales and credit facilities for the retail sector. He also managed the bank’s network of branches in the West Bank, where he was the branch manager in the north, center, and south for several years.

He holds a bachelor’s degree in accounting from Birzeit University, a master’s degree in business administration from Al-Quds University / Abu Dis, and received accredited international certificates, including the Certified Lender Business Banker (CLBB) from the Federation of American Banks.

A financial and banking expert with more than 21 years of experience in the Palestinian banking system and financial affairs. Nawahda’s experience is diverse in these two areas and includes management and control of financial and banking operations, treasury services management, management of administrative affairs, employee affairs and information technology. He also has experience in banking services for the corporate sector, customer service, audit and financial control.

Nawahda worked in the regional department of the Arab Bank in Palestine for 13 years, where he held several positions, including: Director of Banking Operations Supervision, Director of Financial Operations, and Deputy Director of the Banking Operations Sector. He then moved to Jordan Commercial Bank (JCB) where he was the Head of Banking Operations and Support (COO). He started his career at the Palestinian Ministry of Finance, where he was the Head of Internal Audit, and managed the Internal Control Development Department.

He holds a bachelor’s degree in accounting from An- Najah National University. He also has specialized certifications in financial markets and treasury, internal auditing, information security, money laundering (AML), and know your customer (KYC).

Adel Hassan is an engineer with an extensive 24-year experience in IT, digital transformation, information security, cyber security, system management, and e-clouds. He held a number of leadership positions in a number of leading local banks in Palestine.

Hassan began his professional career in 1998, as an electrical engineer in the Bethlehem 2000 project and Jacir Palace. He moved to Cairo Amman Bank / Palestine in 2004 and worked there until 2015 as the Director of the IT Infrastructure Department. He then joined Bank of Palestine as the Director of Infrastructure and IT Projects. Hassan joined TNB in 2020 to develop IT infrastructure and systems and start the bank’s journey of digital transformation.

Hassan made many contributions to artificial intelligence, machine learning, data science and analysis, as well as digital currencies and cryptography. He conducted research and wrote several articles that were approved and published on the largest international scientific platforms.

He holds a bachelor's degree in Electrical Engineering from Birzeit University, and a master's degree in Computer Science from the Arab American University, which he obtained in 2019 before joining a PhD program in Information Technology Engineering.

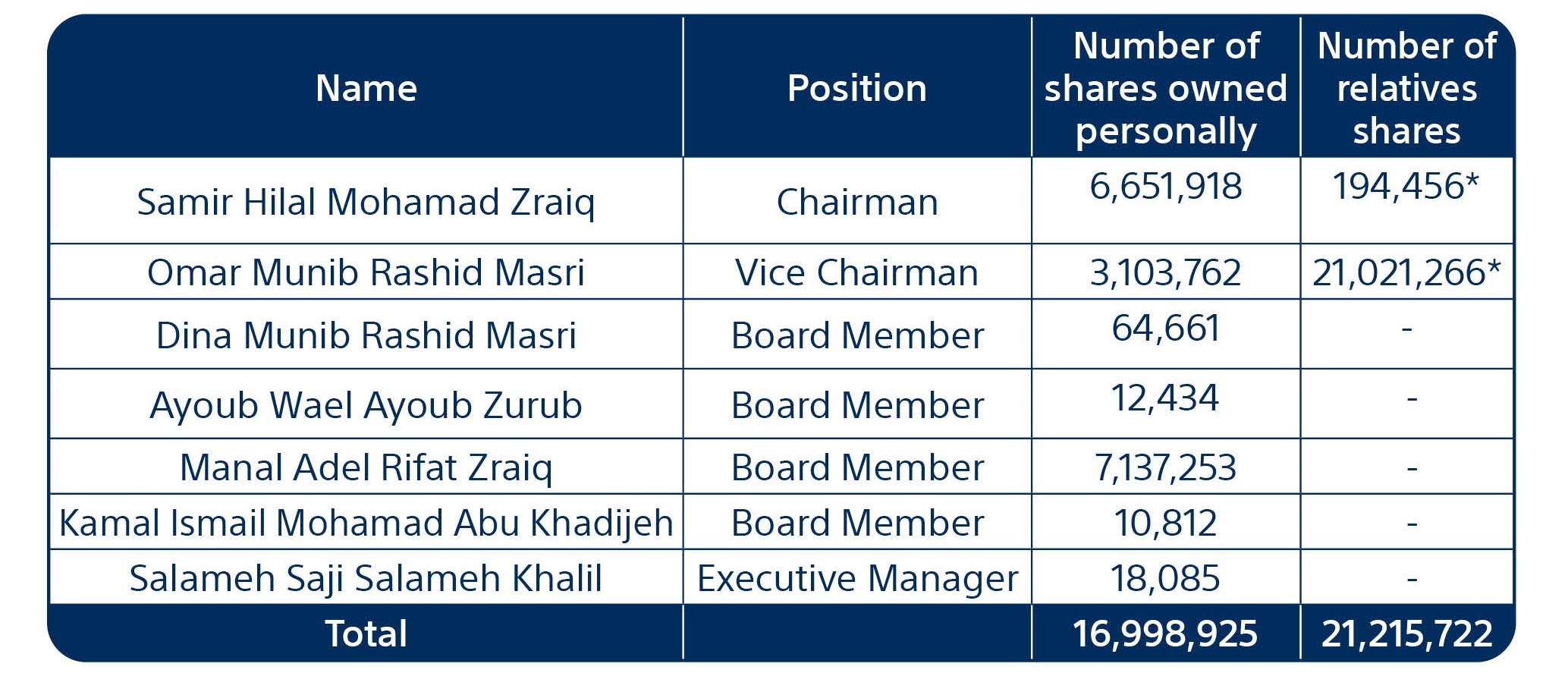

TNB is committed to the principles of transparency and disclosure of all financial information, reports and statements in line with the instructions of the supervisory authorities, namely the Palestinian Capital Market Authority and the PMA. In 2022, a policy of disclosure and transparency, a policy for the protection of shareholders’ rights, and a general framework for interaction and communication with small shareholders were approved. TNB ensures easy access by shareholders and stakeholders to this information by adhering to the disclosure instructions in the Palestine Stock Exchange in addition to its different media channels and social media accounts.

*Excluding relatives shares on board

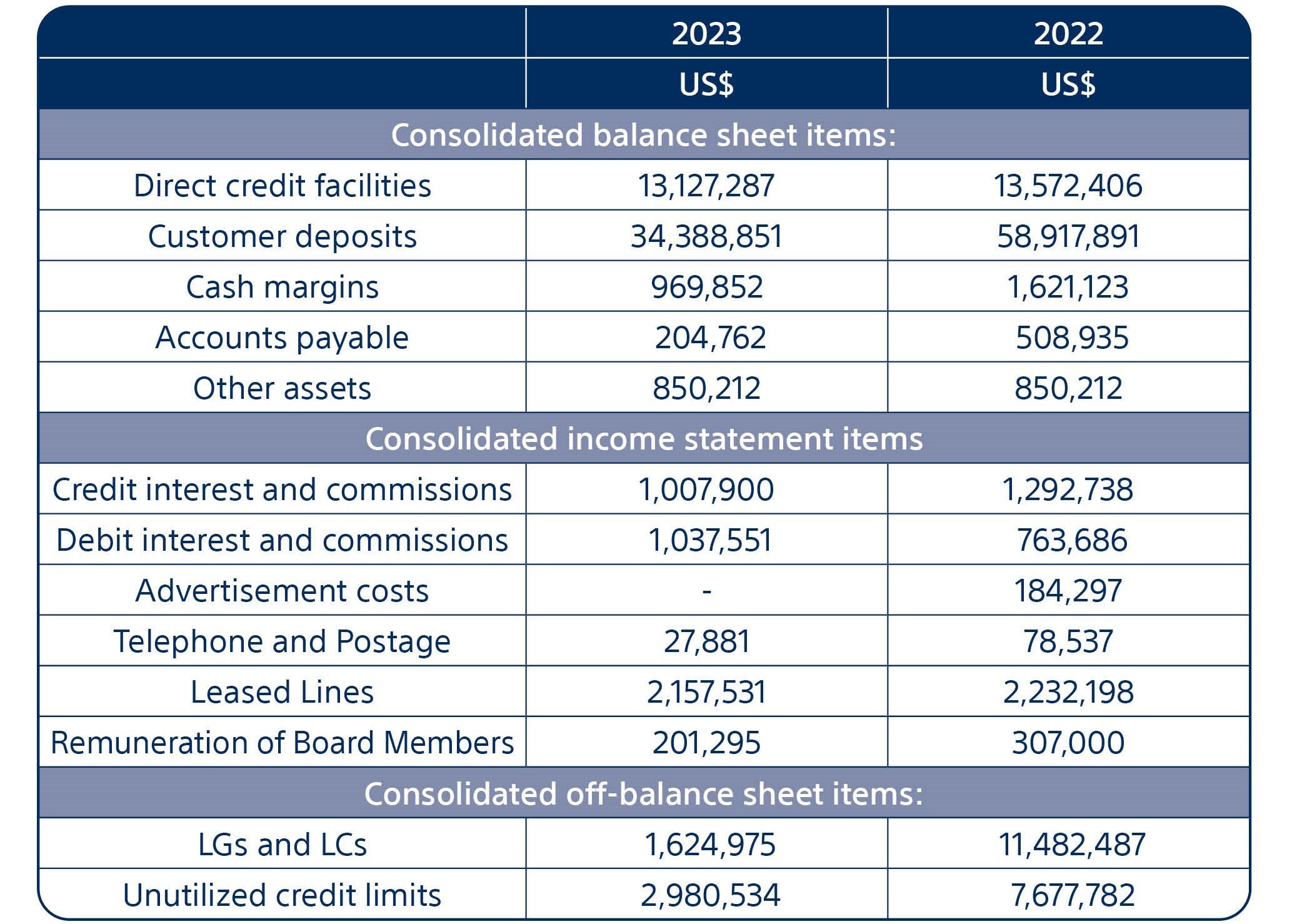

The bank considers major shareholders, the executive management, and majority owned companies as related parties. Throughout the year, there were transactions with these entities consisting of deposits, credit facilities and cash margins, as follows:

*Clarification 38 in the financial statments

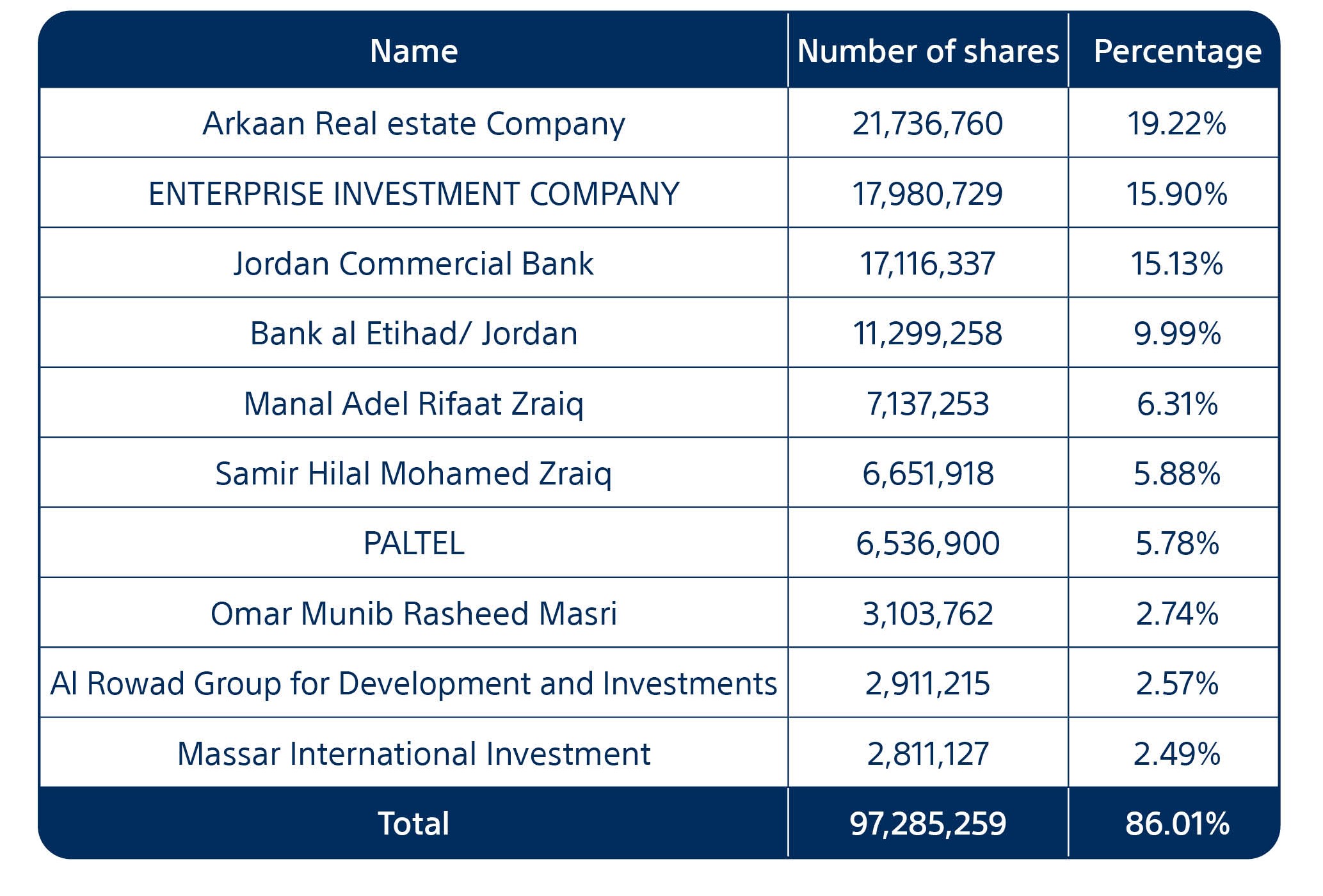

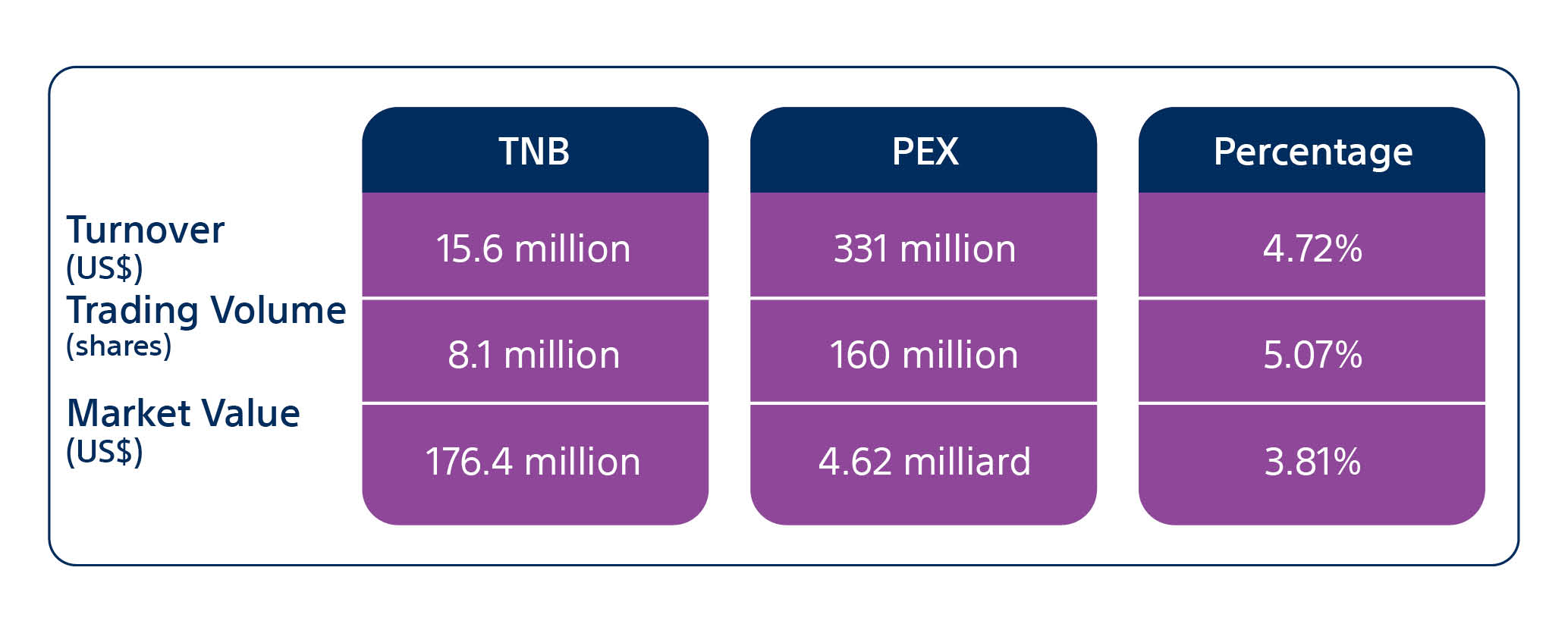

As of 31-12-2023, TNB had 8,422 shareholders, thereby maintaining its position as the largest bank in terms of the number of shareholders in 2023. The trading volume was at US$15,612,404 divided into 8,114,573 shares in 2023. The number of executed contracts was 488.

In 2023, TNB share price reached its highest level since 2020, which was US$2.05.

At the end of 2023, TNB’s Market Value reached US$176.4 which maintained its position as the seconed larget bank in Palestine in terms of Market Value

Ernest and Young – Ramallah – Al Masyoun – Padico House – 7th floor Phone number 02-2421011 P.O. Box 1373

The auditor fees amounted to to US$868,359 during 2023.

There were no penalties imposed on TNB during 2023.

The value of lawsuits filed against the bank reached US$55,560,910 on 31-12-2023. While in the opinion of the legal advisor, and the executive management of the bank they have no legal grounds.

The bank management and the legal advisor estimate that no obligations will result from these lawsuits except for what was allocated.

There are no entities controlling the bank, directly or indirectly.

لا توجد حالات الامتناع عن التصويت الناتجة عن تضارب المصالح وحالات الموافقة على عقود أو معاملات تشمل تضارب المصالح بموجب قانون الشركات وقانون المصارف.

في الحالات التي يوجد فيها معاملات و/أو قرارات مرتبطة بأعضاء مجلس إدارة، يتم استبعادهم من التصويت على تلك المعاملات و/أو القرارات.

There are no local or international main supplier or customers that constitute 10% of the bank’s purchases or sales

There are no governmental privileges or immunities for the bank or any of its products under laws, regulations or others. There are no patents or franchises acquired by the bank.

There was no non-recurring transactions in 2023 in TNB main financial activities.

* تشمل بدلات الأعضاء المستقيلين.